GLOBAL MINIMUM TAX PILLAR 2: THE GLoBE RULES PART 2

Introduction

In our first article (Part 1) on GMT published in February 2023 we delved into the meaning, aims and scope of the Globe Rules (Pillar 2) as well as the five steps approach for calculating the Global Top-up Tax. https://www.dtos-mu.com/part-1-the-globe-rules-pillar-2-explained/

In this present article, we will first touch on ‘’Jurisdictional blending” to ensure that we know exactly how to determine the Effective Tax Rate (ETR) under the Globe Rules on a jurisdictional basis. We will then go through two simple examples to help throw some light on the subject after which we will have a quick look at the key documents released by the OECD from the date the Globe Model Rules were released i.e., 20 December 2021 to date. We will finally try to provide our readers with a summary of the most significant points covered in the GLoBE Model Rules.

Jurisdictional Blending

We have already explained in our previous article on GMT that an MNE’s ETR under the GLoBE Rules will be determined on a jurisdictional basis. Under a jurisdictional blending approach, a GLoBE tax liability will arise when the ETR of a jurisdiction in which the MNE Group operates is below the agreed minimum rate.

To determine the jurisdictional ETR, the MNE Group will first have to determine the income of each entity and then assign that income and the covered taxes paid in respect of that income to the relevant jurisdiction. More specifically, the jurisdictional ETR involves the following two steps:

Step 1

Determine the income of each entity in the group and make adjustments, at the entity level, in respect of consolidation items (Consolidation Adjustments).

Step 2

Assign the income and taxes paid by each entity to a jurisdiction.

Example to illustrate the application of the top up tax under the Income Inclusion Rule (IIR)

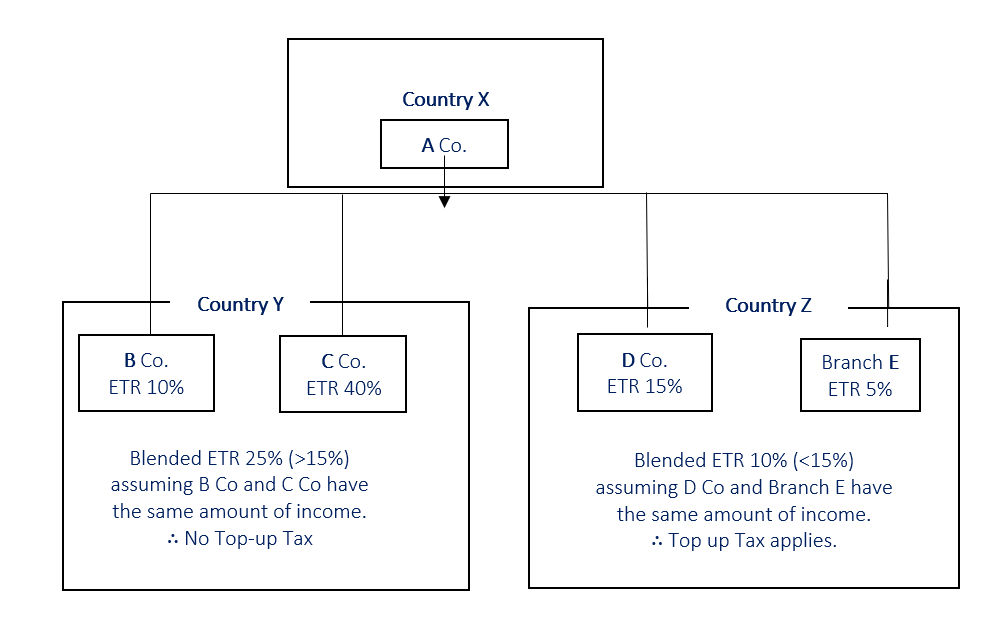

Let us start by examining the diagram below showing the location of the members of the XYZ Group:

A Co, tax resident of Country X, is the Ultimate Parent Entity (UPE) of the XYZ Group which falls within the scope of the GMT. A Co has 3 Subsidiaries namely B Co, C Co and D Co plus a Branch E. B Co and C Co are tax residents in Country Y while D Co is tax resident in Country Z and the Branch E is located in Country Z. Country A has implemented a qualified IIR. Each of B Co, C Co, D Co and Branch E earns income but pays different amounts of tax.

To simplify matters we have assumed that B Co and C Co have the same amount of income and given that their Effective Tax Rate (ETR) in Country Y is 10% and 40 % respectively, the blended ETR for Country Y is 25% which is greater than the GMT of 15%. Therefore, there is no Top-up Tax. On the assumption that D Co and Branch E have the same amount of income and given that their ETR is 15% and 5% respectively the blended ETR for Country Z is 10% which is lower than the GMT of 15%. Therefore, Top up Tax applies. It should be noted that the Switch overrule will treat Branch E in the same manner as a corporation for the purposes of IIR.

The UPE i.e. A Co will be subject to Top up Tax under IIR even if it otherwise has a loss in Country X for the year because IIR does not apply to profit in Country X.

Example to illustrate the application of the top-down approach in a situation where the UPE is not required to apply a Qualified IIR

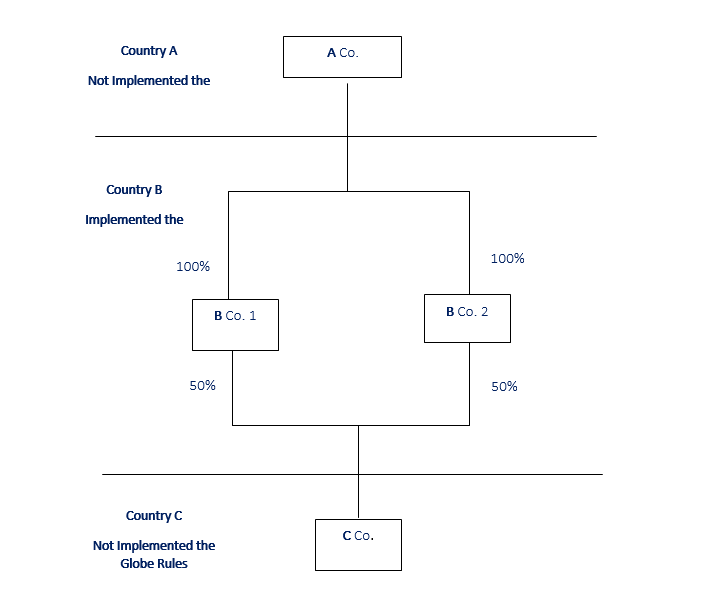

The diagram set out below shows the holding structure and location of the members of the ABC Group:

A Co, the UPE of the ABC Group, located in Country A, directly owns B Co 1 and B Co 2 , both located in Country B. B Co 1 and B Co 2 each hold 50% of the ordinary share capital of C Co located in country C. A Co, B Co 1 and B Co 2 all have an ETR for the fiscal year that is above the Minimum Rate of 15%. However, C Co is a Low-Taxed Constituent Entity (LTCE) located in a Low-Taxed Jurisdiction. Of the three jurisdictions, only Country B has implemented a Qualified IIR.

Country C is a low-Tax Jurisdiction and C Co is a LTCE for the purposes of the GLoBE Rules and any Top-up Tax determined for C Co under the GLoBE Rules will therefore be subject to charge under an applicable IRR.

A Co is the UPE and would have the priority to apply the IIR under the GLoBE Rules if country A had introduced a Qualified IIR. In the present case, however, only country B has introduced a Qualified IIR and thus, the Intermediate Parent Entities (B Co 1 and B Co 2) are required to apply the IIR in accordance with the GLoBE Rules. Under those rules, B Co 1 and B Co 2 must apply the IIR based on their Allocable share of the Top-up Tax (50% each) and pay the Top-up Tax under the IIR equal to the full amount of C Co’s Top- up Tax.

Note: The above example is borrowed from the document prepared by the OECD Secretariat and cited as OECD (2022), The Challenges Arising from the Digitalisation of the Economy – GloBE Rules (Pillar Two) Examples. The Example has been slightly modified for the sake of simplicity.

Key documents released by the OECD from 20 December 2021 to date.

Date of release Key documents

20 December 2021 The Pillar Two Model Rules also referred to as the GLoBE Rules

14 March 2022 Commentary to GLoBE Model Rules which provides detailed and comprehensive

technical guidance on the operation and intended outcomes under the rules and clarifies

the meaning of certain terms.

20 December 2022 Implementation Package for Pillar Two which includes three key documents covering:

1. Guidance on safe harbours and penalty relief

2. Public Consultation document on the GLoBE Information return, and

3. Public Consultation document on tax certainty for the GLoBE Rules

Pillar Two Model Rules or GLoBE Rules

The Model Rules are designed to ensure large MNEs pay a minimum level of tax on the income arising in each jurisdiction where they operate. In the design of the Pillar Two Rules care has been taken to ensure that they accommodate a diverse range of tax systems, including different tax consolidation rules, income allocation, entity classification rules etc, as well as rules for specific business structures such as joint ventures and minority interests. As such, many of the specific provisions of the Model Rules will not apply to all jurisdictions or each individual in-scope MNE.

The Model Rules consist of 10 Chapters. Chapter 1 is concerned with the scope. Chapters 2 to 5 set out the key operative provisions that every in-scope MNE would apply. Normally the following 3 steps would be followed:

- Calculation of the ETR – Chapters 3 and 4 identify the pools of low taxed income on a jurisdictional basis. This is done by calculating the income under Chapter 3, and the tax attributable to that income under Chapter 4.

- Calculation of the top-up tax: Where there is low-taxed income in a jurisdiction, the resulting top-up tax calculation is done under the rules in Chapter 5; and

- Determination of the liability for the top-up tax: If top-up tax is owed, the charging provisions in Chapter 2 apply. These provisions describe which entity within the MNE will be liable for top-up tax in respect of low-taxed income arising in a jurisdiction.

Chapter 6 deals with mergers and acquisitions while Chapter 7 provides special rules that apply to a relatively narrow range of taxpayers subject to tax neutrality and existing distribution regimes. Chapter 8 deals with administration and provides an internationally coordinated approach to administering the rules. This includes a standardised information return to facilitate compliance and reduce burdens on taxpayers. Chapter 8 also provides for the possibility of safe harbours that would reduce administrative burdens, where particular operations of an MNE are almost certain to be taxable above the global minimum rate. Chapter 9 provides for transitional rules that consider existing tax attributes including all pre-existing tax losses, to simplify the application of the rules and reduce compliance burdens when an MNE first comes into scope of the Pillar Two Model Rules. Chapter 10 sets out the necessary definitions, and the rules for determining where an entity is located for the purpose of applying the calculations in Chapter 2 to 5, which are needed to give effect to the jurisdiction-by-jurisdiction approach.

Conclusion

Our readers will appreciate that the GloBE Rules are very complex and require a thorough understanding of both domestic tax law and the relevant financial accounting standards, such as IFRS. They rely on the profits or losses shown in the financial accounts, and subject them to certain adjustments to take account of common differences between tax and accounting. We trust that, through our series of Articles that we plan to publish on this difficult subject, we can summarise in simple words the complex GloBE Rules to make them clear and more comprehensible.

In the two illustrative examples on global minimum top-up tax considered above, in order to keep things simple, we have assumed that the low-taxed jurisdiction has not implemented in its domestic law a Qualified Domestic Minimum Top-up Tax (QDMTT) which is a minimum tax consistent with GloBE. In our next article in the series, we intend to examine in more detail the QDMTT and to comment on the amendments brought to the Income Tax Act by the Finance Act 2022 to cater for any change that may be required in relation to the introduction of QDMTT in Mauritius. We will also try to enlighten our readers by going through some more practical examples to illustrate the application of the global minimum top-up tax in given situations.

Mario HANNELAS

FCCA

Head of Tax Advisory Services Dept

MHannelas@dtos-mu.com

T. +230 52584751